In the digital age, virtual currency has become increasingly popular. With the rise of cryptocurrencies like Bitcoin and Ethereum, many people are looking for secure ways to store and manage their digital assets. One solution that has gained traction is the software wallet.

A software wallet is an online application that allows users to store, send, and receive cryptocurrencies. It is a digital wallet that exists only in the virtual world. Unlike a traditional wallet that holds physical cash, a software wallet holds digital assets on the blockchain. This makes it a convenient and secure way to manage your cryptocurrency holdings.

One of the key benefits of a software wallet is its ease of use. With just a few clicks, users can set up a wallet and start sending and receiving cryptocurrencies. There is no need for complicated hardware or physical storage devices. Everything is managed online, making it accessible from anywhere with an internet connection.

Another advantage of using a software wallet is the level of security it offers. Most software wallets use encryption and other security measures to protect users’ funds. Additionally, many software wallets offer features like multi-factor authentication and backup options, further enhancing the security of your digital assets.

Overall, a software wallet is a practical and secure solution for managing your cryptocurrency holdings. With its convenience and security features, it is no wonder that more and more people are turning to software wallets as their preferred method of storing and transacting with virtual currencies.

What Is a Software Wallet for Crypto?

A software wallet for crypto, also known as a virtual or online wallet, is a type of software that allows individuals to securely store, manage, and transact with their cryptocurrency. It is a digital wallet specifically designed to hold cryptocurrencies such as Bitcoin, Ethereum, and other digital assets.

The software wallet operates on the principles of blockchain technology, which is a decentralized and transparent system that enables secure transactions. It leverages cryptographic algorithms to ensure the privacy and security of users’ digital assets.

Features of a Software Wallet for Crypto:

1. Security: Software wallets utilize advanced encryption techniques to protect the private keys, ensuring that only the owner has access to their cryptocurrency. Additionally, many software wallets offer features like two-factor authentication and biometric authentication for enhanced security.

2. Accessibility: As online wallets, software wallets can be accessed from any device with an internet connection, providing users with flexibility and convenience in managing their cryptocurrency portfolio.

3. Backup and Recovery: Software wallets typically offer options for backing up and recovering wallets, allowing users to restore access to their funds in case of device loss or failure.

4. Transaction Management: Software wallets enable users to send and receive cryptocurrency, view transaction history, and monitor account balances. They also support features like QR code scanning for simplified transactions.

5. Compatibility: Software wallets are designed to be compatible with different types of cryptocurrencies, providing users with the flexibility to manage various digital assets within a single wallet.

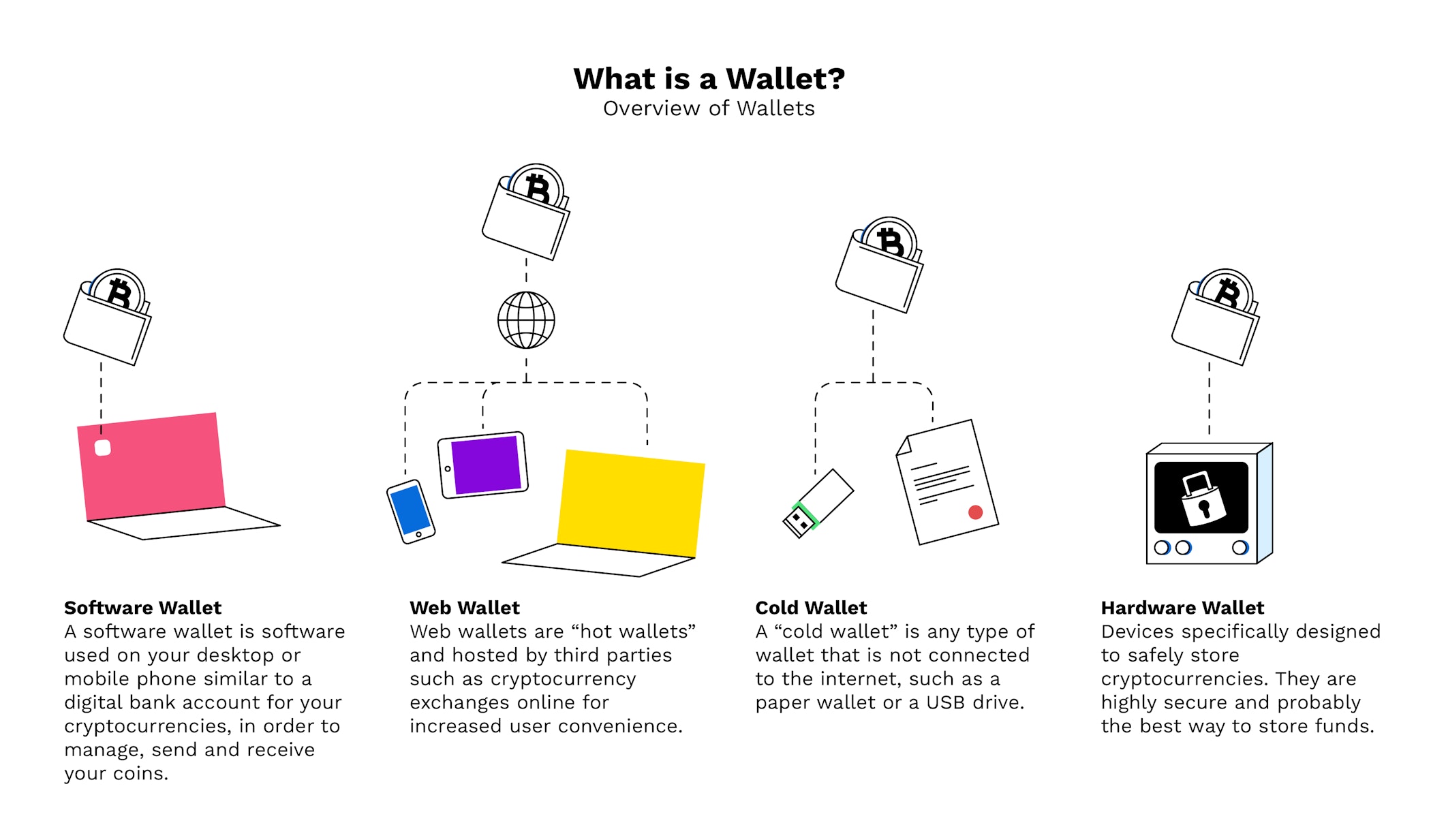

Types of Software Wallets:

There are different types of software wallets available, including:

- Desktop Wallets: These wallets are installed on a computer or laptop and offer a high level of security. Users have complete control over their private keys and can store them offline.

- Mobile Wallets: These wallets are designed for smartphones and provide convenience in managing cryptocurrencies on the go. They are typically more vulnerable to security threats compared to desktop wallets.

- Web Wallets: These wallets can be accessed through a web browser and are provided by cryptocurrency exchanges or third-party service providers. While they offer convenience, users must trust the security measures implemented by the provider.

The choice of software wallet depends on individual preferences and requirements, considering factors such as security, accessibility, and compatibility with the desired cryptocurrencies.

The Advantages of Using a Software Wallet

A software wallet is a virtual wallet that allows users to store, manage, and transact with their cryptocurrency. It is an online tool that uses software to securely store and access digital currency. There are several advantages to using a software wallet over other types of wallets.

1. Convenience

Using a software wallet is convenient because it allows users to access their cryptocurrency online. They can manage their funds from anywhere with an internet connection, making it easy to send and receive payments and track their transactions.

2. Security

Software wallets provide a high level of security for storing cryptocurrency. They use encryption techniques and secure keys to protect the user’s funds. Additionally, most software wallets offer features like two-factor authentication and backup options, which further enhance the security of the wallet.

3. Accessibility

Software wallets are accessible to anyone with an internet connection and a device, such as a computer or a smartphone. This makes them available to a wide range of users, regardless of their location or financial background. The accessibility of software wallets promotes financial inclusion and empowers individuals to participate in the digital currency ecosystem.

4. Compatibility

Software wallets are compatible with multiple cryptocurrencies, as they are designed to work with various blockchain platforms. This allows users to manage different types of digital currency within a single wallet, eliminating the need for multiple wallets and simplifying the user experience.

5. User Control

When using a software wallet, users have full control over their cryptocurrency. They hold the private keys, which are necessary to access and manage their funds. This gives users the freedom to make transactions at their own discretion and eliminates the need for third-party intermediaries.

6. Cost-Efficiency

Software wallets are generally more cost-effective compared to hardware wallets or other physical forms of cryptocurrency storage. They do not require any additional hardware and can be downloaded and used for free, making them a cost-efficient option for managing digital assets.

7. Regular Updates

Software wallets are updated regularly to enhance their security features and improve user experience. Users can benefit from these updates by keeping their wallets up to date and taking advantage of the latest security patches and improvements.

In conclusion, software wallets offer numerous advantages for cryptocurrency users. They provide convenience, security, accessibility, compatibility, user control, cost-efficiency, and regular updates. These benefits make software wallets a popular choice for individuals looking to safely store and manage their digital assets.

The Security Features of a Software Wallet

When it comes to storing and managing digital assets such as cryptocurrency, having a secure and reliable wallet is essential. A software wallet is a type of digital wallet that allows users to store, send, and receive cryptocurrency. One of the key advantages of a software wallet is the security features it provides.

1. Encryption

Software wallets utilize advanced encryption techniques to secure the private keys associated with the users’ cryptocurrency. These private keys are required to access and transfer the funds. By using encryption, software wallets ensure that the private keys remain protected and inaccessible to unauthorized individuals.

2. Two-factor authentication

Many software wallets offer two-factor authentication (2FA) as an additional layer of security. This means that in addition to the password, users need to provide a second form of verification, such as a unique code sent to their mobile device, to access their wallet. 2FA significantly reduces the risk of unauthorized access even if the password is compromised.

3. Offline storage

Some software wallets allow users to store their cryptocurrency offline, also known as cold storage. This means that the private keys are stored on a device that is not connected to the internet, reducing the risk of being hacked or compromised by online threats. By keeping the private keys offline, software wallets provide an extra layer of protection against unauthorized access.

4. Backup and recovery

Software wallets often offer backup and recovery options, allowing users to create copies of their wallet and easily restore them if needed. This feature is crucial in case of device loss, damage, or in the event of forgetting the security credentials. By having a backup, users can ensure that their cryptocurrency is not permanently lost and can easily recover their funds.

5. Multi-factor authentication

Some software wallets offer multi-factor authentication (MFA) as an additional security measure. This feature requires users to provide multiple forms of verification, such as a password, a fingerprint scan, and an email confirmation, to access their wallet. MFA significantly enhances the security of the wallet by adding multiple layers of authentication.

Conclusion

Software wallets provide various security features to ensure the safe storage and management of cryptocurrency. Encryption, two-factor authentication, offline storage, backup and recovery, and multi-factor authentication are some of the key security features offered by software wallets. By utilizing these security measures, users can have peace of mind knowing that their cryptocurrency is protected from unauthorized access.

How to Choose the Right Software Wallet

- Consider the currency: When choosing a software wallet, it is important to consider the type of currency you will be using. Some wallets only support specific cryptocurrencies, while others support a wide range of digital currencies. Make sure the wallet you choose is compatible with the currency you plan to use.

- Research the software: Before selecting a software wallet, it is important to research the software behind it. Look for information about the company or developer that created the wallet, as well as any reviews or feedback from other users. This will give you an idea of the wallet’s reputation and reliability.

- Security features: Security is paramount when dealing with cryptocurrencies. Look for a software wallet that offers strong encryption and multi-factor authentication. Additionally, consider whether the wallet allows you to control your own private keys, as this gives you more control over your funds.

- User experience: A good software wallet should have an intuitive and user-friendly interface. Look for wallets that offer a simple and easy-to-understand user experience, as well as features that make it easy to send, receive, and manage your cryptocurrency.

- Online or offline: Software wallets can be either online or offline. Online wallets store your cryptocurrency on a server that is accessible through the internet, while offline wallets store your cryptocurrency on a device that is not connected to the internet. Consider your needs and preferences when choosing between online and offline wallets.

- Backup and recovery: Accidents happen, and it is important to have a plan in place for backing up and recovering your software wallet. Look for wallets that offer backup and recovery options, such as seed phrases or backup files, to ensure that you can easily recover your cryptocurrency in case of a lost or stolen device.

The Convenience of a Virtual Wallet Blockchain

A virtual wallet blockchain, also known as a digital wallet or software wallet, is an online platform that allows users to securely store, send, and receive digital currencies such as crypto and cryptocurrency. It provides a convenient and efficient way to manage virtual currency transactions without the need for physical cash or traditional banking systems.

One of the key benefits of a virtual wallet blockchain is its accessibility. Users can access their digital wallets from anywhere with an internet connection, making it easy to make transactions on the go. Unlike physical wallets, a virtual wallet is not limited by geography or time, allowing for seamless transactions across borders and time zones.

Another advantage of using a virtual wallet is the increased security it provides. Digital currencies are stored in a secure blockchain network, which uses advanced encryption algorithms to protect user information and prevent unauthorized access. This makes virtual wallets more secure than traditional wallets, which are susceptible to theft or loss.

A virtual wallet blockchain also offers a higher level of privacy compared to traditional banking systems. While traditional banks require users to disclose personal information and complete extensive verification processes, virtual wallet platforms typically only require minimal identification, maintaining user anonymity.

In addition to convenience, security, and privacy, a virtual wallet blockchain offers various features and functionalities. Users can easily track their cryptocurrency balances, view transaction history, and generate reports for tax or accounting purposes. They can also set up alerts and reminders to stay informed about any changes or updates in the cryptocurrency market.

| Benefits of a Virtual Wallet Blockchain |

|---|

| Convenience |

| Accessibility |

| Security |

| Privacy |

| Tracking and Reporting |

| Alerts and Reminders |

In conclusion, a virtual wallet blockchain offers numerous advantages for managing digital currencies. Its convenience, accessibility, security, and privacy make it an attractive option for both casual users and experienced cryptocurrency traders. With the ability to track balances, view transaction history, and set up alerts, a virtual wallet blockchain provides a comprehensive solution for managing virtual currency transactions.

What Is an Online Wallet for Digital Currency?

An online wallet for digital currency, also known as a virtual or cryptocurrency wallet, is a software application that allows individuals to securely store, manage, and transact digital currencies. With the rise of cryptocurrencies like Bitcoin, Ethereum, and others, the need for a secure and convenient way to store and manage these assets has become paramount.

A cryptocurrency wallet utilizes blockchain technology, which is a decentralized and distributed ledger that ensures the integrity and security of digital transactions. By using cryptographic algorithms, digital wallets can securely store private keys, which are essential for accessing and transferring digital currencies. The private keys are mathematical sequences that allow users to prove ownership of their digital assets and authorize transactions.

The main advantage of using an online wallet is convenience. Unlike physical wallets or hardware wallets, digital wallets can be accessed from anywhere with an internet connection. This accessibility allows users to manage their digital currency holdings on the go, without the need for physical storage devices. Additionally, online wallets often provide user-friendly interfaces that make it easy to view balances, send and receive funds, and monitor transaction history.

Online wallets also offer a high level of security. They utilize advanced encryption techniques to protect users’ private keys and digital assets. Additionally, online wallets are often protected by multi-factor authentication methods, such as passwords, biometric authentication, or two-factor authentication, which adds an extra layer of security to prevent unauthorized access.

However, it is important to note that online wallets are still vulnerable to hacking and phishing attacks. Users should take precautions to ensure the security of their online wallet, such as using strong passwords, enabling two-factor authentication, and being cautious of phishing attempts.

Types of Online Wallets

There are several types of online wallets available for managing digital currencies:

- Hosted Wallets: These are online wallets provided by cryptocurrency exchanges or third-party service providers. Users’ private keys are held by the service provider, offering convenience but also introducing a level of trust in the provider’s security measures.

- Non-custodial Wallets: These wallets give users full control over their private keys, ensuring that only they have access to their digital assets. Non-custodial wallets are often software-based, and users are responsible for safeguarding their private keys.

- Mobile Wallets: These wallets are specifically designed for use on mobile devices, allowing users to manage their digital currencies on the go. Mobile wallets provide convenience and often feature additional security measures, such as biometric authentication.

- Web Wallets: Web wallets are accessed through a web browser and do not require any software installation. They are convenient for quick access but may introduce additional security risks, as the private keys are stored online.

Conclusion

An online wallet for digital currency serves as a secure and convenient way to store, manage, and transact cryptocurrencies. By utilizing blockchain technology and advanced encryption techniques, online wallets offer users the ability to access their digital assets from anywhere with an internet connection. However, it is essential for users to take precautionary measures to protect their online wallets and ensure the security of their digital currencies.

The Benefits of Using an Online Wallet

Online wallets have become increasingly popular in the world of digital currency and cryptocurrency. They offer a convenient and secure way to store and manage your virtual assets. Here are some key benefits of using an online wallet:

- Convenience: One of the main advantages of an online wallet is its convenience. You can access your wallet anytime, anywhere as long as you have an internet connection. This makes it easy to manage your virtual assets on the go.

- Security: Online wallets provide enhanced security measures to protect your digital currency. They typically use encryption techniques to safeguard your funds and personal information. Additionally, many online wallets also offer two-factor authentication, which adds an extra layer of security.

- Easy Access to Blockchain: By using an online wallet, you can easily access the blockchain network. This allows you to view your transaction history, check your balances, and track the progress of your transactions.

- Diversification: Online wallets often support multiple cryptocurrencies. This means you can store different types of virtual currencies in a single wallet, which is convenient if you have diverse investments.

- Backup and Recovery: Online wallets usually offer backup and recovery options. This ensures that even if your device is lost or damaged, you can easily restore your wallet and access your funds.

- Ease of Use: Online wallets are designed to be user-friendly, making them accessible to both experienced and novice users. They typically have intuitive interfaces and clear instructions, making it easy for anyone to navigate and use the wallet.

In conclusion, using an online wallet offers numerous benefits in terms of convenience, security, and accessibility. With the increasing popularity of digital currency and cryptocurrency, online wallets have become an essential tool for managing and storing virtual assets.

The Risks Associated with Online Wallets

- Security vulnerabilities – Online wallets are more susceptible to security breaches and hacking attempts compared to other types of wallets. Since they are virtual and connected to the internet, they can be targeted by cybercriminals who try to steal users’ crypto assets.

- Third-party control – When using an online wallet, users need to place their trust in the wallet provider. They rely on the provider’s security measures and protocols to keep their digital currency safe. However, this means that users do not have complete control over their crypto assets, as the wallet provider has access to the private keys.

- Phishing attacks – Cyber attackers may attempt to trick online wallet users into revealing their private keys and sensitive information through phishing attacks. This can lead to unauthorized access to the wallet and the loss of funds.

- Server downtimes – Online wallets depend on the availability and uptime of their servers. If a server goes down or experiences technical issues, users may not be able to access their funds, causing inconvenience and potential financial loss.

- Dependency on internet connection – Online wallets require a stable internet connection to access and manage funds. If the internet connection is disrupted or unavailable, users may not be able to perform transactions or access their crypto assets.

- Offline versus online – Offline wallets, such as hardware or paper wallets, provide an extra layer of security by keeping the private keys offline. Online wallets, on the other hand, store the private keys on the internet, making them more vulnerable to hacking attempts and security breaches.

In conclusion, while online wallets offer convenience and easy accessibility to crypto assets, they also come with inherent risks. Users should carefully consider these risks and take appropriate security measures to protect their digital currency and personal information.

How to Secure Your Online Wallet

When it comes to storing your crypto assets, using an online wallet can offer convenience and accessibility. However, it’s important to take steps to secure your online wallet to prevent unauthorized access and protect your digital currency.

Choose a Reliable Online Wallet

Before creating an online wallet, it’s crucial to choose a reputable and reliable provider. Look for wallets that have a proven track record, strong security measures, and positive user reviews. Research the wallet’s reputation in the crypto community and make sure it has a good standing.

Create a Strong Password

A strong password is one of the first lines of defense for your online wallet. Avoid using common passwords and opt for a unique combination of letters, numbers, and special characters. It’s also important to regularly update your password to minimize the risk of it being compromised.

Enable Two-Factor Authentication

Two-factor authentication adds an extra layer of security to your online wallet. By requiring an additional verification step, such as a unique code sent to your mobile device, two-factor authentication helps prevent unauthorized access even if your password is compromised.

Keep Your Software Updated

Regularly updating the software of your online wallet is essential for staying protected against security vulnerabilities. Keep an eye out for wallet updates and make sure to install them promptly to take advantage of the latest security enhancements and bug fixes.

Use a Hardware Wallet for Large Amounts

If you have a significant amount of cryptocurrency, consider using a hardware wallet. Hardware wallets store your crypto assets offline, providing an extra layer of security against online threats. They are not connected to the internet, making it nearly impossible for hackers to gain access to your funds.

Be Cautious of Phishing Attempts

Phishing is a common tactic used by cybercriminals to steal sensitive information. Be wary of suspicious emails, links, or messages that request your wallet login credentials or personal information. Always double-check the authenticity of the source before providing any sensitive data.

Backup Your Wallet

To protect your online wallet from data loss or device failure, it’s essential to regularly backup your wallet. Store multiple copies of your wallet’s backup in secure offline locations, such as external hard drives or encrypted cloud storage.

Monitor Your Account and Transactions

Regularly monitor your online wallet for any unauthorized activity or suspicious transactions. Set up alerts or notifications to receive updates on your account and keep a close eye on your transaction history. If you notice any suspicious activity, report it immediately to your wallet provider.

Protect Your Computer and Network

Securing your online wallet goes beyond just the wallet itself. Ensure that your computer and network are also protected against malware, viruses, and other online threats. Keep your operating system and antivirus software up to date and be cautious when downloading files or visiting unfamiliar websites.

Use Cold Storage for Long-Term Storage

If you plan to hold your digital currency for an extended period, consider using cold storage options such as paper wallets or offline hardware wallets. Cold storage provides an extra layer of protection by keeping your crypto assets completely offline, away from potential online threats.

| Summary |

|---|

| Securing your online wallet is crucial to protect your digital currency from unauthorized access and potential online threats. By following these steps, such as choosing a reliable wallet provider, creating a strong password, enabling two-factor authentication, and regularly updating your software, you can enhance the security of your online wallet and have peace of mind knowing that your crypto assets are safe. |

Understanding the Digital Wallet for Cryptocurrency

A digital wallet, also known as a virtual wallet or e-wallet, is a software application that allows users to securely store and manage their cryptocurrency. It is a crucial component of the blockchain technology as it enables users to send, receive, and store their digital currencies in a safe and convenient manner.

Unlike traditional wallets that hold physical money and cards, a digital wallet is purely virtual. It exists online and can be accessed through a desktop or mobile device. Digital wallets are specifically designed for storing cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, which are forms of digital or virtual currency.

The primary purpose of a digital wallet is to provide users with a secure and user-friendly interface to manage their cryptocurrency assets. It allows users to view their account balance, track transaction history, and generate new wallet addresses for receiving funds. Additionally, digital wallets typically offer features like two-factor authentication and encrypted backup options to enhance security.

One of the main advantages of using a digital wallet for cryptocurrency is the convenience it offers. With a digital wallet, users can access their funds anytime and anywhere, as long as they have an internet connection. This eliminates the need for physical cash or credit cards and allows for seamless online transactions and purchases.

Furthermore, a digital wallet ensures the ownership and control of the user’s cryptocurrency. Unlike exchanges or custodial services, where users have to trust a third party with their funds, a digital wallet allows users to maintain full control over their private keys. Private keys are essential for accessing cryptocurrency funds and conducting transactions on the blockchain.

Overall, a digital wallet is an essential tool for anyone interested in the world of cryptocurrency. It provides a secure and convenient way to store, manage, and transact with digital currencies. By utilizing a digital wallet, users can take advantage of the benefits offered by online, software-based wallets, and have full control over their cryptocurrency assets.

The Future of Digital Wallets in the Crypto Space

In the rapidly evolving world of cryptocurrency, digital wallets play a crucial role. As more and more individuals and businesses embrace the use of blockchain technology and virtual currencies, the demand for secure and convenient digital wallet solutions continues to grow.

A digital wallet, also known as an e-wallet, is a software application that allows users to securely store, manage, and transact with their cryptocurrency. It acts as a virtual wallet for blockchain-based digital currencies, providing a user-friendly interface for individuals to access and control their funds.

One of the key advantages of using a digital wallet for cryptocurrency is its security. Unlike traditional wallets, which can be lost or stolen, digital wallets use advanced encryption techniques to protect sensitive information and secure transactions. Furthermore, most digital wallets require multiple layers of authentication, such as PIN codes and biometric data, to ensure that only the authorized user can access the funds.

Another benefit of digital wallets is their convenience. With a digital wallet, users can easily send and receive funds from anywhere in the world, as long as they have an internet connection. This eliminates the need for physical currency and traditional banking systems, making transactions faster and more efficient.

Furthermore, digital wallets support a wide range of cryptocurrencies, allowing users to hold and manage multiple digital assets in a single platform. This makes it easier for individuals and businesses to diversify their holdings and take advantage of the growing number of cryptocurrency options available in the market.

The future of digital wallets in the crypto space looks promising. As blockchain technology continues to advance and gain wider adoption, the demand for digital wallets is expected to increase. In addition to their role as a secure storage and transaction tool, digital wallets have the potential to become a gateway for other financial services, such as lending, investment, and decentralized applications.

Moreover, the integration of digital wallets with other online platforms, such as e-commerce websites and social media platforms, is already being explored. This would allow users to easily make purchases using their cryptocurrency holdings, as well as facilitate peer-to-peer transactions and social tipping.

In conclusion, digital wallets are playing a vital role in the crypto space and are expected to shape the future of the financial industry. With their security, convenience, and versatility, digital wallets are enabling individuals and businesses to seamlessly transact with cryptocurrency and participate in the growing digital economy.

Frequently Asked Questions:

What is a software wallet for crypto?

A software wallet for crypto is a digital wallet that allows users to securely store and manage their cryptocurrencies. It is a software application that can be installed on a computer or mobile device.

How does a software wallet differ from a hardware wallet?

A software wallet is a digital wallet that is stored on a computer or mobile device, while a hardware wallet is a physical device that stores cryptocurrency offline. Software wallets are more convenient but may be vulnerable to hacking, while hardware wallets provide enhanced security.

What are the benefits of using a software wallet for crypto?

Using a software wallet provides convenience as users can access their cryptocurrencies from any device with an internet connection. Software wallets also usually offer a wide range of features and support multiple cryptocurrencies.

Are software wallets safe?

Software wallets can be safe if proper security measures are taken. Users should choose a reputable wallet provider, enable two-factor authentication, and keep their wallet software up to date. It is also recommended to store a backup of the wallet’s private key in a secure location.

Can I use a software wallet for online transactions?

Yes, a software wallet can be used for online transactions. Users can send and receive cryptocurrencies easily through their software wallet. However, it is important to ensure that the website or platform where the transaction is being performed is secure and trustworthy.

Videos:

Crypto Wallets Explained (Beginners’ Guide!) How to Get Crypto Off Exchange Step-by-Step ✔️

The PERFECT Cold Hardware Wallet – Explained

Can software wallets be hacked easily?

While no system is completely hack-proof, software wallets generally have robust security measures in place to protect against hacking attempts. They use encryption protocols, multi-factor authentication, and other advanced security features to safeguard your digital assets. However, it is always recommended to practice good security hygiene like using strong passwords and keeping your software wallet up to date to minimize the risk of hacking.

I completely agree with the article. Software wallets are a game changer in the world of cryptocurrencies. They are easy to set up and provide a high level of security for managing your digital assets. With the increasing popularity of virtual currencies, a software wallet is a must-have for any crypto enthusiast.

Software wallets are a game-changer for managing cryptocurrency! It’s so easy and convenient to have all my digital assets in one place, and the security measures give me peace of mind. No more worries about physical storage devices or complicated hardware. Love it!

Can software wallets be hacked? How secure are they compared to hardware wallets?

Software wallets have become increasingly secure over time, with encryption and other security measures in place to protect your funds. While no system is completely immune to hacking, software wallets offer a high level of security if you follow best practices. It is always recommended to use a reputable software wallet and keep your device and software up to date. Hardware wallets, on the other hand, offer an additional layer of security by keeping your private keys offline. However, software wallets are still a popular choice for their convenience and accessibility. Ultimately, it is a matter of personal preference and the amount of cryptocurrency you are storing.

Can you explain how the encryption in software wallets ensures the security of my digital assets? I’m curious to know more about the specific measures implemented.

Hey crypto_enthusiast! Great question. Encryption plays a crucial role in ensuring the security of your digital assets in software wallets. When you set up a software wallet, an encryption algorithm is used to convert your private key into a complex string of characters. This encrypted private key acts as a password to access and manage your digital assets. Only with the correct encryption key can your funds be unlocked and utilized. Additionally, most software wallets implement robust encryption techniques such as AES (Advanced Encryption Standard) or RSA (Rivest-Shamir-Adleman) to further safeguard your digital assets. These encryption methods make it incredibly challenging for potential hackers or unauthorized individuals to crack the code and gain access to your funds. Rest assured, software wallets prioritize security and employ the latest encryption measures to protect your cryptocurrency holdings.

Software wallets are great for managing and storing my crypto assets securely. I love how convenient they are to use, without the need for any physical storage devices. Plus, the online accessibility makes it so much easier to access my cryptocurrency from anywhere. Highly recommended!

How do software wallets compare to hardware wallets in terms of security?

In terms of security, software wallets and hardware wallets have their own pros and cons. While hardware wallets are generally considered more secure since they store your private keys offline, software wallets have also made significant advancements in security measures. Many software wallets use encryption and offer features like two-factor authentication to protect your funds. It ultimately depends on your personal preference and level of comfort with technology. If you prefer a more user-friendly and convenient option, a software wallet can be a good choice. However, if maximum security is your top priority, a hardware wallet may be the better option.

This article provides a great overview of the benefits of software wallets for managing cryptocurrencies. I’ve been using a software wallet for a while now and it’s made managing my digital assets much more convenient. The added security measures also give me peace of mind. Highly recommend!

Software wallets are a game-changer! They make managing cryptocurrencies so much easier and more convenient. No need for physical storage devices or complicated hardware. Plus, the security measures make me feel safe and confident in managing my digital assets.

As someone who has been using a software wallet for a while now, I can definitely attest to its benefits. It’s so easy to set up and use, and I feel much more secure knowing that my cryptocurrencies are protected with encryption. Plus, I love the convenience of being able to manage everything online. Highly recommend!

Software wallets are a game changer! I love how easy it is to set up and manage my digital assets without any complicated hardware. Plus, the added security measures give me peace of mind knowing that my funds are protected. Highly recommend!

Software wallets are the best! I love how easy it is to manage all my cryptocurrencies in one place. Plus, I can access it from anywhere without carrying any physical devices. Highly recommend!

Software wallets have revolutionized the way we manage and store our cryptocurrencies. I love how easy it is to set up a digital wallet and start transacting securely. It’s the future of finance!

Could you please explain how software wallets ensure the security of users’ funds and protect against hacking?

Hi Emily88, great question! Software wallets employ several security measures to ensure the safety of users’ funds. Firstly, they use encryption technology to protect sensitive information like private keys and passwords. This means that even if a hacker were to gain access to your software wallet, they would not be able to decipher the encrypted data.

Additionally, software wallets often require users to set up strong passwords and use two-factor authentication for an added layer of security. Two-factor authentication typically involves a code sent to your mobile device or email that you need to enter along with your password to gain access to your wallet. This adds extra protection against unauthorized access.

Furthermore, software wallets are designed to be resistant to hacking attempts. Developers regularly release updates to address security vulnerabilities and improve the software’s overall security. It’s always important to keep your software wallet up to date to benefit from the latest security patches.

Remember, no storage solution is completely impenetrable, but software wallets provide a high level of security when used correctly. I hope this clarifies the security aspect of software wallets for you!

I have been using a software wallet for managing my cryptocurrencies for over a year now and I must say it has been a game changer. The ease of use and convenience it offers is unparalleled. I can access my digital assets from anywhere with an internet connection and securely store them on the blockchain. It’s a must-have for anyone who wants to dive into the world of crypto!

Software wallets are a game-changer in the crypto world. They make managing and storing digital assets so easy and convenient. I’ve been using a software wallet for a while now and it has never let me down. The security features are top-notch, giving me peace of mind knowing that my cryptocurrencies are safe and secure.

Software wallets are a game-changer for managing cryptocurrencies. They provide a secure and convenient way to store and transact digital assets. No more worries about physical storage devices or complicated hardware. It’s all online and accessible from anywhere. Definitely a must-have for crypto enthusiasts.

Software wallets are a game-changer for managing crypto! It’s so much more convenient to have all my digital assets securely stored online. No more worrying about physical wallets or hardware. Plus, the ease of use is unbeatable. Highly recommend!

Is it safe to store all my cryptocurrencies in a software wallet? How can I be sure that my digital assets won’t be hacked?

Hey Jennifer43, storing your cryptocurrencies in a software wallet can be safe if you take the necessary precautions. Firstly, make sure to choose a reputable software wallet with a strong track record of security. Look for wallets that have undergone thorough security audits. Additionally, enable two-factor authentication to add an extra layer of protection. Regularly update your wallet software to stay up to date with the latest security patches. Finally, consider using a hardware wallet as a backup for added security. By following these steps, you can ensure that your digital assets are well protected from hacking attempts.

I’ve been using a software wallet for a while now and it has made managing my cryptocurrencies so much easier. I love how I can access it from anywhere with an internet connection. Plus, the security measures give me peace of mind knowing my funds are protected. Highly recommend!

Software wallets are great! They make managing my cryptocurrencies so much easier. I love that I can access my digital assets from anywhere with just a few clicks. Plus, the security measures give me peace of mind knowing that my funds are safe.

I have been using a software wallet for quite some time now and I must say, it has made managing my cryptocurrencies a breeze. No more worrying about physical storage or complicated hardware. With just a few clicks, I can send and receive funds securely. It’s convenient and reliable!

Wow, this article really explains the benefits of using a software wallet for managing cryptocurrencies. It’s fantastic how easy it is to set up and use one, without needing any physical devices. Plus, the added security features provide peace of mind. Definitely worth trying out!

I’ve been using a software wallet for quite some time now and it has been amazing! It’s so easy to manage my crypto assets online and I feel confident that my funds are secure. The convenience and security that a software wallet provides are truly unmatched. Highly recommend!

As a cryptocurrency investor, I have been using software wallets for a while now and I must say, they have made managing my digital assets so much easier. With a software wallet, I can securely store, send, and receive cryptocurrencies with just a few clicks. The convenience and ease of use are unmatched. I highly recommend using a software wallet for anyone in the crypto space.

Software wallets are a game changer! They make managing and storing my digital assets so much easier. No need to carry around physical wallets anymore, everything is secure in the virtual world. Plus, the ease of setting up and using a software wallet is fantastic. Highly recommend!

I really appreciate the convenience and security that software wallets provide. With just a few clicks, I can easily manage and store my cryptocurrencies online. The encryption and other security measures make me feel confident that my funds are protected. It’s definitely a hassle-free way to handle digital assets.

Can software wallets be hacked?

Yes, software wallets can be hacked, just like any other online platform. However, reputable software wallet providers invest heavily in security measures to protect users’ funds. It’s important to choose a trusted wallet and follow best practices for cybersecurity, such as using two-factor authentication and keeping your wallet’s software up to date. Remember, no wallet is completely immune to hacking, but using a software wallet with strong security features significantly reduces the risks.

I’ve been using software wallets for a while now and they’re a game changer. It’s so convenient to manage my crypto assets online without the hassle of physical storage. Plus, the level of security they provide gives me peace of mind. Highly recommend!

I really appreciate the convenience and security that software wallets provide. Being able to manage my digital assets online and easily send and receive cryptocurrencies with just a few clicks is so much more convenient than dealing with physical cash. Plus, knowing that my funds are protected with encryption and other security measures gives me peace of mind. Software wallets have definitely made managing my cryptocurrency holdings a lot easier!

Can software wallets be hacked? How secure are they?

Software wallets can indeed be vulnerable to hacking, just like any other online platform. However, if you take the necessary precautions, they can be highly secure. It’s important to choose a reputable software wallet with a strong track record in security. Additionally, enabling two-factor authentication and regularly updating your software can add an extra layer of protection. Remember to never share your wallet’s private keys with anyone and be cautious when accessing your wallet from public Wi-Fi networks. By following these best practices, you can significantly reduce the risk of your software wallet being hacked.

Software wallets are a game-changer for managing cryptocurrencies. I love how easy it is to set up and use them. Plus, they provide a secure way to store my digital assets. No more worries about physical storage devices or complicated hardware. Highly recommend!

Can you explain how exactly a software wallet encrypts and secures users’ funds?

Hi JohnSmith, great question! A software wallet encrypts and secures users’ funds by using complex cryptographic algorithms. When you set up a software wallet, it generates a unique private key that is used to encrypt and decrypt your funds. This private key is only accessible to you and is required to authorize any transactions. Additionally, software wallets often offer features such as two-factor authentication and biometric authentication, adding an extra layer of security. Rest assured, your funds are protected by state-of-the-art encryption technology in a software wallet.

Software wallets are definitely the way to go when it comes to managing your crypto. They are so convenient and user-friendly compared to hardware wallets. Plus, with all the security measures in place, I feel safe knowing my assets are protected. Highly recommend!

I have been using software wallets for quite some time now and I can say that they are a game-changer. The convenience of managing my digital currency online is unmatched. Plus, with the encryption and security measures in place, I feel confident that my funds are safe and secure. Highly recommend using software wallets for anyone interested in cryptocurrencies!

I have been using a software wallet for my cryptocurrencies and it has been a game changer for me. The convenience of managing my digital currency online is unmatched. Plus, the security measures provided by the software wallet give me peace of mind. Highly recommend!

Do software wallets support all types of cryptocurrencies? Are there any limitations?

Yes, software wallets generally support a wide range of cryptocurrencies. However, it is important to note that certain software wallets may have limitations on the specific cryptocurrencies they can support. It is always recommended to do thorough research and check the compatibility of the software wallet with the cryptocurrencies you intend to store. Additionally, some wallets may require users to manually add new cryptocurrencies or update the wallet software to support the latest cryptocurrencies. It’s essential to stay informed and choose a software wallet that meets your specific needs and cryptocurrency preferences.

I have been using a software wallet for managing my cryptocurrencies for quite some time now. The convenience it offers is unparalleled. I can access my digital assets from anywhere with an internet connection and easily send and receive cryptocurrencies with just a few clicks. Plus, the level of security provided by encryption and other measures gives me peace of mind.

Software wallets are a game-changer for crypto enthusiasts like me. It’s so easy to manage my digital assets securely without having to worry about physical storage. I highly recommend using a software wallet for hassle-free transactions!

Software wallets are great! They provide an easy and convenient way to manage and store my cryptocurrencies online. I love the fact that I don’t need any physical storage devices and can access my assets from anywhere.

Software wallets are a game-changer! I love how easy it is to manage my cryptocurrencies online. No more worrying about physical storage and hardware. Plus, the security measures give me peace of mind.

How secure are software wallets compared to hardware wallets?

Software wallets provide a high level of security with encryption measures to safeguard your funds. While hardware wallets are considered the most secure option due to their offline storage, software wallets are still a reliable and convenient choice for managing your cryptocurrencies online.

Software wallets are a game-changer for managing cryptocurrencies. They provide a secure and convenient way to store and transact digital assets online. I appreciate the ease of setting up and using a software wallet, making it accessible from anywhere with an internet connection.

Have you tried using a software wallet for your cryptocurrencies? How does it compare to traditional wallets in terms of security and convenience?

SarahOnline, I have been using a software wallet for my cryptocurrencies, and it has been a game-changer! The convenience of managing my digital assets online is unmatched. In terms of security, I feel much safer knowing that my funds are protected with encryption and other advanced security measures. I highly recommend giving a software wallet a try for your cryptocurrency needs!

How do software wallets ensure the security of my digital assets? Can they prevent hacking and unauthorized access?

Hi AmandaSmith89, software wallets ensure the security of your digital assets through advanced encryption techniques and secure authentication protocols. They are designed to prevent hacking and unauthorized access by implementing robust security measures. By storing your cryptocurrencies on the blockchain and using secure private keys, software wallets offer a high level of protection for your digital assets. Rest assured that your funds are safe and secure with a reputable software wallet provider.

As a cryptocurrency enthusiast, I believe that software wallets are essential for securely managing digital assets. The convenience of online access combined with the security features like encryption make software wallets a preferred choice for storing and transacting in cryptocurrencies.

Software wallets are a game-changer when it comes to managing cryptocurrencies. They provide a secure and convenient way to store digital assets online. I believe virtual wallets on the blockchain are the future of decentralized transactions.

Software wallets are definitely the way to go for managing your crypto. They provide the convenience and security needed in today’s digital world. I’ve been using a software wallet for a while now, and it’s been a smooth experience all the way.

Software wallets are a game-changer for managing my cryptocurrencies. I love how easy it is to use them and the peace of mind they provide with their security features. I feel much more in control of my digital assets now.

How do software wallets ensure the security of my cryptocurrencies? Do they provide backup options in case of system failures?

Software wallets rely on advanced encryption techniques to secure your cryptocurrencies. They typically offer backup options such as seed phrases that can restore your funds in case of system failures. It’s crucial to follow best practices like keeping your seed phrase safe and not sharing it with anyone.

How does a software wallet ensure the security of my cryptocurrencies, especially in terms of protecting against hacking or phishing attempts?

A software wallet enhances security by utilizing advanced encryption technologies to protect your cryptocurrencies. It creates multiple layers of security against hacking or phishing attempts, ensuring that your digital assets remain safe and secure. Additionally, some software wallets offer additional security features such as two-factor authentication to further safeguard your funds.

As a cryptocurrency enthusiast, I believe that software wallets are essential in today’s digital age. Their convenience and security features make managing digital assets a seamless experience. I highly recommend using a software wallet for anyone actively involved in the crypto space.

Software wallets are the future of managing cryptocurrencies online. They provide a convenient and secure way to store digital assets without the need for physical storage devices. I believe that virtual wallets on the blockchain are essential for safe and decentralized transactions in today’s digital age.

Software wallets are a game-changer for managing my crypto assets efficiently. I love how easy it is to send and receive cryptocurrencies without the hassle of physical storage. The security measures in place also give me peace of mind knowing my funds are safe online.

Software wallets are definitely the way to go in this digital age. They provide a convenient and secure solution for managing cryptocurrencies online. With minimal setup required, it’s easy for anyone to start using a software wallet to store and transact with digital assets.

How do software wallets ensure the security of cryptocurrencies stored online?

Software wallets ensure the security of cryptocurrencies stored online through robust encryption methods and advanced security protocols. These wallets use private keys to securely access and manage your digital assets, making it difficult for unauthorized parties to gain access to your funds. Additionally, reputable software wallet providers continuously update their software to address any potential vulnerabilities and enhance overall security measures. By utilizing multi-factor authentication and implementing secure login procedures, software wallets offer a high level of protection for your cryptocurrencies.

Software wallets are truly a game-changer in the world of cryptocurrency management. They provide a seamless experience for handling digital assets securely online. The convenience and security offered by software wallets make them an essential tool for any crypto investor.

Have there been any reported cases of software wallets being hacked or compromised? I’m interested in understanding the potential risks involved with using a software wallet for managing crypto.

Hi AmyCryptoFan, in the realm of cryptocurrency, security is paramount. While no system can be completely immune to hacking attempts, reputable software wallets continuously update their security protocols to safeguard users’ assets. It’s crucial to choose a well-established software wallet with a strong track record and to implement additional security measures such as two-factor authentication to reduce the risks associated with managing your crypto holdings. Stay informed and stay secure!

Software wallets are a game-changer in the world of cryptocurrency. They provide a secure and convenient way to manage digital assets online. I believe that using a software wallet is essential for anyone looking to safeguard their investments in the digital currency space.

In my opinion, software wallets are a game-changer for cryptocurrency management. The convenience of being able to access and control your digital assets online is unparalleled. Plus, the security measures in place make me feel confident in using them for my transactions.

Software wallets are a game-changer for managing my cryptocurrencies. The convenience of online access and secure transactions make it a top choice for digital asset holders like myself.

Software wallets are a game-changer for managing cryptocurrencies online. The ease of use and security they provide make them a reliable choice for storing digital assets in the virtual world.

Software wallets are a game-changer for crypto enthusiasts like myself. The convenience of managing digital assets online and the security provided by encryption make it a reliable choice for secure transactions.

As a cryptocurrency enthusiast, I believe that software wallets are essential for managing digital assets safely and conveniently. With the increasing popularity of virtual currencies like Bitcoin and Ethereum, having a secure online solution like a software wallet is crucial. The ease of use and high level of security provided by software wallets make them a valuable tool for anyone involved in the crypto space.

Could you provide more information on how software wallets ensure the security of users’ funds?

Absolutely! Software wallets employ advanced encryption techniques to safeguard users’ funds. By generating private keys and utilizing secure protocols, software wallets provide a secure environment for managing and transacting cryptocurrencies. Furthermore, most software wallets have additional security layers such as two-factor authentication to prevent unauthorized access. Overall, using a software wallet significantly reduces the risk of fraud and theft in the digital asset space.

As a cryptocurrency enthusiast, I truly appreciate the convenience and security that software wallets provide. Managing my digital assets online has never been easier thanks to these virtual wallets on the blockchain. It’s amazing how technology has revolutionized the way we handle our finances!

As a crypto enthusiast, I believe that software wallets are a game-changer for managing digital assets securely. They make it incredibly convenient to handle cryptocurrencies online and ensure decentralized transactions on the blockchain. The ease of setup and accessibility from anywhere with an internet connection are definitely major advantages.

As a long-time investor in cryptocurrencies, I can attest to the convenience and security of using a software wallet. Managing my digital assets has never been easier, thanks to the user-friendly interface and robust security features of software wallets. I highly recommend it to anyone looking to enter the world of digital currencies.

As a tech enthusiast, I believe software wallets are the future of managing cryptocurrencies. The convenience and security they provide make it a no-brainer for anyone looking to safeguard their digital assets. With just a couple of simple steps, you can start using a software wallet to store and transact with your crypto securely online. It’s truly a game-changer in the world of digital finance!

Software wallets have truly revolutionized the way we manage our digital assets. They provide a secure and convenient way to store and transact with cryptocurrencies online. I appreciate the ease of use and level of security offered by software wallets, making it simple for anyone to start their journey in the world of digital currencies.

Software wallets are truly a game-changer in the world of cryptocurrencies. The convenience they provide in managing and securing digital assets is unmatched. With just a few simple steps, anyone can start using a software wallet to store and transact with their cryptocurrencies. It’s a modern solution for modern financial needs.

Software wallets are a game-changer for cryptocurrency enthusiasts! They provide a user-friendly interface for managing digital assets securely. With just a few simple steps, you can start using a software wallet to access, send, and receive your cryptocurrencies. The convenience and security they offer make software wallets a must-have tool in today’s digital world.

As a cryptocurrency enthusiast, I truly believe that software wallets are a game-changer in the digital asset management sphere. The convenience of managing my cryptocurrencies online with just a few clicks is unmatched. Plus, the security features give me peace of mind knowing that my funds are well-protected in the virtual world.

Software wallets are definitely a game-changer when it comes to managing cryptocurrencies. I appreciate the convenience they offer in securely storing and easily accessing digital assets. The security features give me peace of mind knowing my funds are protected online.

I think software wallets are a game-changer for crypto enthusiasts. The convenience of managing digital assets online is unmatched. Plus, the security features give me peace of mind knowing my funds are safe and secure.

I believe that software wallets are essential for anyone looking to securely manage their cryptocurrencies. The ease of use and level of security they provide make them a valuable tool for navigating the world of digital assets. With the increasing popularity of virtual currencies, having a reliable software wallet is crucial for anyone involved in the crypto space.

Software wallets are a game-changer for managing my crypto holdings. I love how easy it is to send and receive digital currencies securely online. The convenience and security they provide are unmatched!

Software wallets provide a user-friendly and convenient way to securely manage your cryptocurrencies online. I believe that the ease of use and security features of software wallets make them a reliable choice for anyone looking to safeguard their digital assets.

Software wallets are a game-changer in the crypto world! The ease of use and security they provide make managing digital assets a breeze. Virtual wallets on the blockchain are definitely the way to go for safe and decentralized transactions.

Software wallets are so convenient! I love how easy it is to manage my crypto online without the need for physical devices. The security features also give me peace of mind.

As a tech enthusiast, I believe that software wallets are a game-changer in the world of cryptocurrency. The convenience of managing digital assets online and the secure transactions on the blockchain make them a must-have for any serious crypto investor.

Software wallets are indeed a game-changer for managing cryptocurrencies online. They provide a convenient and secure way to handle digital assets. With the increasing popularity of virtual currencies, a software wallet is essential for anyone looking to securely store and transact with their digital wealth.

Software wallets are truly a game-changer for anyone looking to dive into the world of cryptocurrency. The convenience of managing digital assets online is unmatched, and the security measures in place provide peace of mind for users. It’s amazing how technology has evolved to make transactions secure and decentralized.

How does a software wallet provide security for cryptocurrencies stored online? Is it safer than hardware wallets?

AmySmith, a software wallet enhances security by using encryption and secure online protocols to safeguard your cryptocurrencies. While hardware wallets are considered very secure due to their offline storage, software wallets offer convenience and accessibility since they can be used from any device connected to the internet.

Software wallets are a game-changer for crypto enthusiasts like me. Managing my digital assets is now hassle-free with the convenience they provide. I strongly believe in the security and efficiency of virtual wallets on the blockchain for all my transactions.

I believe software wallets are an excellent choice for managing cryptocurrencies. They offer such convenience and security! With the user-friendly interfaces, it’s easy to set up and start using them right away. I feel much more confident knowing my assets are protected with encryption. Definitely a smart move for anyone getting into crypto!

Thanks for this informative article! I’m curious, can you explain how software wallets compare in security to hardware wallets?

Hello Laura! Great question! While software wallets generally offer convenience and user-friendly features, hardware wallets provide an extra layer of security as they’re offline and less susceptible to hacking. It really depends on how you use your crypto—if you’re frequently transacting, a software wallet might be suitable, but for long-term storage, a hardware wallet is often recommended. Hope that helps!

I’m really intrigued by the security features of software wallets mentioned in the article. Can you explain more about the types of encryption used to protect funds?

Absolutely, JessicaMoon86! The security of software wallets primarily relies on encryption methods like AES (Advanced Encryption Standard) and RSA (Rivest-Shamir-Adleman). These algorithms help secure your private keys and transaction data, making it exceedingly difficult for unauthorized users to gain access. It’s crucial to choose a reputable wallet that implements robust security protocols. Always do your research!

I love how easy it is to manage my crypto with a software wallet! I’ve tried several, and they really make sending and receiving digital currencies a breeze. Plus, the security features give me peace of mind that my assets are safe. Definitely a game-changer for anyone getting into crypto!

I find software wallets to be incredibly user-friendly and convenient! It’s amazing how easily I can manage my crypto assets from anywhere with just my phone. The security features give me peace of mind, especially with all the news about hacks lately. I definitely recommend trying one out if you’re new to cryptocurrencies!

This article is informative! I’m curious, how do the security features of software wallets compare to hardware wallets in real-world scenarios?

Thanks for your question, Jessica! In real-world scenarios, software wallets can be quite secure, especially with strong encryption and two-factor authentication. However, hardware wallets are generally considered safer for long-term storage since they keep your keys offline. It really depends on how you plan to use your crypto. For easy access and transactions, software wallets are great, but for holding large amounts, hardware wallets might be the better choice.

I absolutely love the convenience of software wallets! They make managing my cryptocurrencies so easy, and I feel secure knowing my funds are protected with encryption. It’s a game changer for anyone looking to dive into the crypto world!

I’m curious, how do software wallets compare to hardware wallets in terms of security? Are there specific features that make one safer than the other?

Hi Jack, great question! While software wallets are more convenient, they can be more vulnerable to online threats compared to hardware wallets, which are typically more secure because they store your keys offline. Hardware wallets have features like two-factor authentication and are less susceptible to hacking. It really depends on your needs, but if security is your main concern, a hardware wallet might be the way to go!

I believe using software wallets is a smart choice for anyone looking to manage their cryptocurrencies easily and securely. The convenience of accessing my digital assets from anywhere makes it a no-brainer. Plus, the security features give me peace of mind. Definitely a great option for both beginners and experienced users alike!

I found your article on software wallets quite informative! Can you explain how the security features you mentioned compare to those of hardware wallets?

Thanks for your question, Jessica! The security features of software wallets can offer convenience, but hardware wallets generally provide a higher level of protection because they store your keys offline. Software wallets are vulnerable to online attacks, while hardware wallets are more resilient against hacking. It really comes down to your individual needs and how often you plan to access your crypto assets.

I recently started using a software wallet for my cryptocurrencies, and I can’t believe how easy it is! The setup was straightforward, and I love that I can access my funds from anywhere. The security features make me feel much safer compared to keeping everything on an exchange. Highly recommend for anyone looking to manage their digital assets!

Great article! I’m curious, how do software wallets compare in security to hardware wallets?

Thanks, SarahTechie! While both software and hardware wallets have their strengths, hardware wallets are often considered more secure since they store the private keys offline. However, software wallets have improved significantly in security and are very convenient for everyday use. It’s all about finding the balance that works for you!

I think software wallets are a game-changer for managing cryptocurrencies! They’ve made it so much easier to send and receive digital assets without the hassle of dealing with hardware. Plus, the security features really put my mind at ease. It’s great knowing my funds are protected while I enjoy the convenience of accessing them anywhere. Definitely a must-have for anyone in the crypto space!

I truly believe that software wallets are the way to go for managing cryptocurrencies. They not only provide convenience but also security, which is essential in today’s digital world. It’s so easy to set one up, and being able to access my funds from anywhere is a game changer. Definitely a step in the right direction for crypto users!

I absolutely love using my software wallet! It makes managing my cryptocurrencies so much easier. The convenience of being able to access my funds from anywhere is a game changer, and I feel confident knowing that my assets are secured with strong encryption. I can’t imagine going back to anything else!

I believe that software wallets are a game-changer for managing cryptocurrencies. Their ease of use allows anyone, even beginners, to start investing and transacting in digital currencies without the hassle of complicated hardware. Plus, the security measures they implement give me peace of mind knowing my investments are protected. Overall, I think software wallets are essential for anyone looking to navigate the crypto space safely!

Great article! I’m curious, what measures should I take to ensure my software wallet remains secure while managing my cryptocurrencies?